Token Standards Explained: A Founder's Guide

ERC-20, ERC-721, ERC-1400, ERC-3643 — which token standard fits your project? A practical decision framework for founders navigating compliance.

Token standards are smart contract interface specifications that define how tokens behave on a blockchain — what they can do, who can hold them, and what compliance rules are enforced at the protocol level. The standard you choose determines your compliance capabilities, ecosystem compatibility, and whether a costly migration is in your future.

#Why Token Standards Matter Now

Token standard selection used to be a technical footnote. Today it's a foundational business decision. As regulatory clarity emerges and institutional capital enters crypto, the choice between standards has real consequences for compliance, listings, and investor confidence.

The scale of this shift is significant. On-chain representations of tokenized assets crossed $36 billion in 2025, led by cash, treasuries, and money market instruments moving onchain (Source: Silicon Valley Bank). And 76% of global institutional investors plan to expand digital asset exposure in 2026, with nearly 60% expecting to allocate over 5% of AUM (Source: Coinbase Institutional via B2BROKER).

"The future of tokenized finance depends on standardization. ERC-3643 gives the industry a common language for compliant tokenization." — Luc Falempin, CEO of Tokeny & Head of Product Apex Digital, Apex Group (Hedera Blog)

That institutional demand is driving projects toward standards that support compliance from day one — not as an afterthought. We've advised 80+ projects on token design, and standard selection is one of the first conversations we have.

#What Token Standards Actually Do

A token standard defines the functions your token contract must implement so that wallets, exchanges, and other contracts know how to interact with it. Think of it like choosing between a standard electrical outlet and a specialized industrial connector — one works with everything, the other handles specific requirements.

According to Nethermind and PwC Germany's analysis of tokenization standards, ERC-1400 and ERC-3643 are tailored for security tokens, embedding compliance mechanisms such as KYC, AML, and transfer restrictions directly into the protocol layer (Source: Nethermind/PwC).

Three properties define every token standard:

Fungibility — Are all tokens identical and interchangeable, or is each one unique? This determines whether your token can list on standard exchanges or needs specialized marketplaces. It's not just technical — it shapes your entire go-to-market.

Transfer mechanics — Can anyone send tokens freely, or do transfers pass through compliance checks? The transfer model is where regulatory compliance lives. ERC-20 operates as a compliance-blind standard — tokens move freely without checks, which becomes a problem for regulated assets needing oversight and transfer limits (Source: Primior).

Metadata and state — What information does each token carry beyond a balance? Can tokens have properties, partitions, or conditions? More metadata means more capability but also more complexity.

#The Standards Landscape

The Ethereum ecosystem has more token standards than most founders realize. They fall into three categories based on primary use case.

#Fungible Token Standards

ERC-20 — The original and most widely used fungible standard. Every token is identical. Simple transfer model: you own a balance, you send it to any address. No built-in compliance, no transfer restrictions, no metadata. Maximum ecosystem compatibility.

ERC-20 works for utility tokens where unrestricted transferability is a feature. It doesn't work when you need to control who holds the token or restrict transfers based on jurisdictional rules. The vast majority of DeFi, governance, and utility tokens use ERC-20.

Limitations: No built-in transfer hooks, no compliance mechanisms, no way to recover tokens sent to wrong addresses. Extensions exist (ERC-20 with wrapper contracts), but they add complexity and audit surface area.

ERC-4626 — A standard for tokenized vaults built on top of ERC-20. It defines how tokens represent shares in a yield-bearing pool — lending protocols, yield aggregators, and proportional-share systems. If you're building a vault, ERC-4626 gives you standardized composability. If not, this isn't your standard.

#Non-Fungible Token Standards

ERC-721 — The NFT standard. Each token has a unique ID and carries distinct metadata. For tokenomics purposes, ERC-721 matters when tokenizing individual real-world assets — specific properties, unique commodities, or individual debt instruments where each token represents a specific thing.

ERC-1155 — Multi-token standard supporting both fungible and non-fungible tokens in a single contract. More gas-efficient than deploying separate ERC-20 and ERC-721 contracts for mixed token systems. Useful for gaming ecosystems, multi-asset platforms, or projects needing both fungible rewards and non-fungible assets.

#Security Token Standards

This is where it gets critical for projects with compliance requirements — which, increasingly, is most projects.

ERC-1400 — The first widely adopted security token standard. Introduces partitions (different classes of the same token), document management, and controllable transfers. Key capabilities include forced transfers for legal enforcement, partition-based management for different share classes, and issuer-controlled redemption.

The tradeoff with ERC-1400 is operational overhead. These features require an active issuer role — someone must manage partitions, approve transfers, and handle corporate actions. That's manageable for projects with dedicated operations teams, but adds cost that simpler utility tokens don't need.

ERC-1400 also requires offchain-generated keys for trade validation. This introduces an external dependency that can slow settlement and adds a trust assumption your architecture needs to accommodate. For projects comfortable with that tradeoff, ERC-1400's partition capabilities are valuable for multi-tranche structures.

ERC-3643 — Purpose-built for compliant security tokens with identity verification baked in. Uses an onchain identity system (ONCHAINID) that links transfers to verified identities. Transfers succeed only if both parties meet eligibility requirements. ERC-3643 is the industry-leading standard for regulated tokens, incorporating on-chain identity verification, transfer restrictions, and jurisdictional controls essential for institutional adoption (Source: NADCAB).

Where ERC-1400 uses offchain keys, ERC-3643 uses automatic blockchain-based validator systems for compliance enforcement. This means compliance checks happen entirely onchain — no external approval bottleneck. The validator system applies transfer rules related to both user identities and offering-specific requirements.

Tokeny Solutions, the company behind ERC-3643, now powers over $32 billion in tokenized assets (Source: Tokeny). DTCC joined the ERC3643 Association in March 2025, adding support to its ComposerX platform for digital asset markets (Source: DTCC). We covered ERC-3643 in depth in our guide to ERC-3643 and compliant security tokens.

#How to Choose: The Three Questions Framework

The decision framework isn't as complicated as the number of options suggests. Three questions narrow the field. We call this the Three Questions Framework.

#Question 1: Is Your Token a Security?

If yes — or if it might be — you need a security token standard. ERC-20 won't give you the compliance mechanisms your legal team will require. Transfer restrictions, identity verification, and forced transfer capabilities need to be built into the standard, not bolted on afterward.

If no — your token is purely utility or governance — ERC-20 covers most use cases. The simplicity is a feature. Less code means less attack surface, lower audit costs, and broader compatibility.

The "might be" category is where the hard decisions live. If you're unsure about classification, getting a legal opinion early saves you from an expensive standard migration later.

#Question 2: Do You Need Transfer Restrictions?

Transfer restrictions are the dividing line between simple and complex standards.

No restrictions needed: ERC-20. Anyone can hold, send, or receive. Maximum liquidity, maximum composability.

Basic restrictions (accreditation checks, jurisdiction blocking): ERC-1400 provides the framework without prescribing the identity system.

Full compliance with identity verification: ERC-3643 integrates identity into the transfer mechanism. Every transfer checks against onchain identity claims.

#Question 3: Fungible or Non-Fungible?

If every token is interchangeable — share-like ownership, governance rights, utility access — use a fungible standard.

If each token represents a unique asset — a specific property, a unique debt instrument, an individual collectible — use ERC-721.

If you need both in the same ecosystem — ERC-1155 handles the mixed case efficiently.

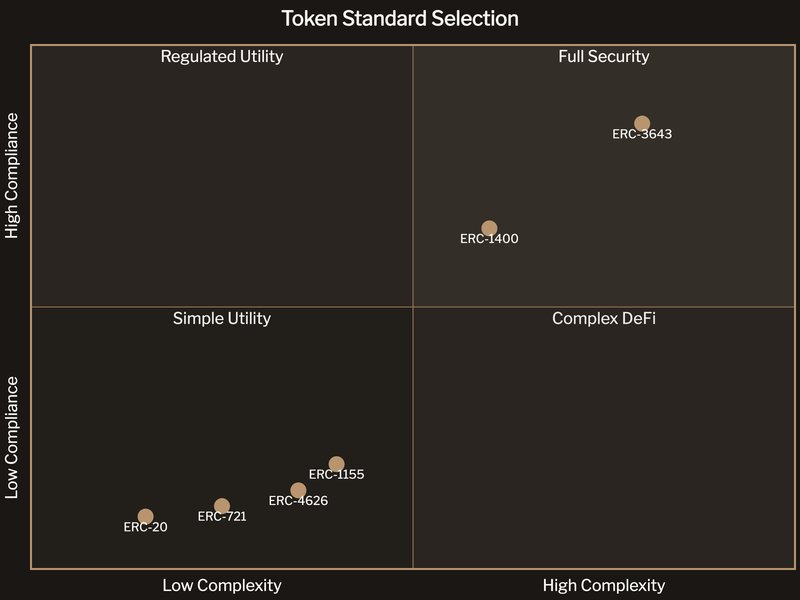

#The Complexity-Compliance Tradeoff

Every step up in compliance capability adds complexity. This translates directly into development costs, audit timelines, and ecosystem compatibility.

ERC-20: Lowest complexity, lowest compliance. Development is fast, audits are straightforward, and every exchange and wallet supports it natively. Zero built-in compliance. Audit costs typically run $10,000-$30,000 for a clean ERC-20 contract. Development timeline: weeks, not months.

ERC-1400: Moderate complexity, moderate compliance. Partition management and controlled transfers require more sophisticated contract architecture. Audit scope increases because partition logic, document management, and controlled transfer mechanisms each introduce attack surface. Fewer wallets and exchanges support the full feature set natively.

ERC-3643: Higher complexity, highest compliance. Onchain identity integration, automated transfer validation, and recovery mechanisms add significant contract surface area. Requires an identity provider relationship — you'll need to integrate with ONCHAINID or a compatible identity framework. Audit costs are higher, and timelines extend to reflect the compliance logic review. Exchange support is growing but not yet universal.

The right choice depends on your regulatory environment, target investors, and growth plan. A project targeting retail DeFi users with no securities characteristics doesn't need ERC-3643's compliance apparatus. A project tokenizing real estate for institutional investors can't function without it. Our EcoYield case study demonstrates how standard selection for an RWA project directly shaped the compliance architecture and investor experience.

#What Migration Actually Costs

We've seen projects choose ERC-20 for speed, then face a migration to ERC-3643 when their legal team flagged the token as a security. That migration isn't just a technical exercise — it's a project-level disruption.

Migration requires deploying a new contract, creating a snapshot of all holder balances, executing a token swap (which requires holder participation or a forced migration mechanism), updating every exchange listing and wallet integration, and re-auditing the entire contract suite. The coordination alone takes weeks. The engineering and audit costs typically exceed what you'd have spent choosing the right standard from the start.

The lesson: spend the time on standard selection before launch. The cost of getting it right upfront is a fraction of the cost of migrating later.

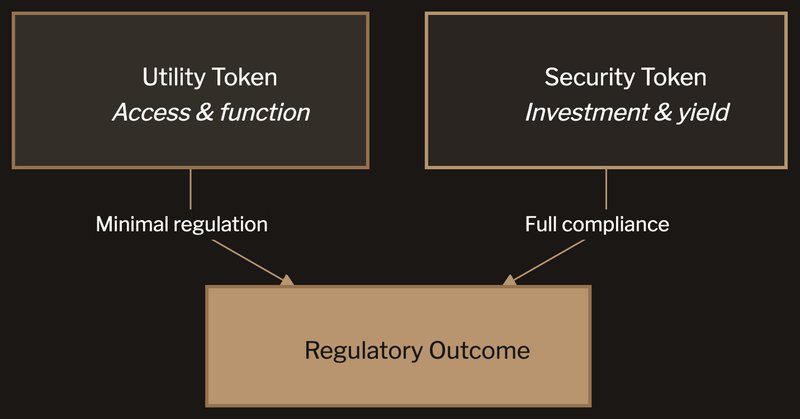

#Utility vs. Security: The Classification Question

The utility-security distinction drives more token standard decisions than any other factor. And it's not always clear-cut.

Utility tokens provide access to a product or service within an ecosystem. Their value comes from what you can do with them, not from an expectation of profit from others' efforts. If your token genuinely functions as a utility, ERC-20 is the standard path.

Security tokens represent an investment in a common enterprise with an expectation of profits derived from others' efforts. If your token looks like a security, it needs a security token standard with built-in compliance.

The gray area is large. Governance tokens with revenue sharing? Staking tokens with yield? Utility tokens sold to investors who clearly expect appreciation? These cases require legal analysis, not assumptions.

The regulatory landscape is also shifting fast. The GENIUS Act, signed in 2025, established federal standards for stablecoins. The anticipated Clarity Act aims to define classification boundaries for digital assets more broadly. MiCA in Europe already provides a framework that projects targeting EU markets must navigate. Your standard selection needs to account for where regulation is heading, not just where it is today.

Our recommendation: get the legal opinion before choosing the standard. We've seen projects choose ERC-20 for simplicity, then spend months migrating to ERC-3643 when their legal team reviewed the actual token mechanics. That migration cost more than choosing the right standard from day one.

#Standards and Your Data Room

Your token standard selection belongs in your tokenomics data room. Investors and their technical advisors review this closely because the standard determines:

- Compliance capability — Can the token enforce the transfer restrictions your legal framework requires?

- Ecosystem compatibility — Which exchanges, wallets, and DeFi protocols support the token?

- Upgrade path — How does the token evolve if regulatory requirements change?

- Audit scope — How much code needs review and how complex is the attack surface?

A complete data room includes not just the selection but the rationale — why this standard serves your compliance needs, business model, and growth plan. The data room checklist covers the full inventory.

#What to Document

Your data room should include a token standard selection memo covering three areas. First, the decision rationale: which standards you evaluated, why you chose this one, and what alternatives you rejected and why. Second, the compliance mapping: how the standard's capabilities align with your legal requirements across each jurisdiction you operate in. Third, the integration assessment: which exchanges, wallets, and DeFi protocols support your standard, and what limitations exist.

Investors who have seen enough token launches know that undocumented technical decisions are usually unconsidered technical decisions. The memo demonstrates rigor. It also protects you — when regulators ask why you chose a particular standard, you have a written record of the analysis that informed the decision.

#Hybrid Approaches

Some projects combine standards to get the best of multiple worlds. A common pattern for RWA tokenomics uses ERC-721 for the underlying asset representation (each property or debt instrument gets a unique token) and ERC-3643 for fractional ownership tokens (compliant, fungible shares in the underlying asset).

This hybrid approach adds architectural complexity but can solve real problems. A real estate portfolio might use ERC-721 to represent individual properties with their unique metadata, then issue ERC-3643 fractional tokens against each property for investor access. The compliance layer lives at the fractional token level where transfers happen.

The risk of hybrid architectures is integration complexity. Each additional standard multiplies your audit scope, exchange integration work, and ongoing maintenance burden. Only go hybrid when a single standard genuinely can't serve your use case — not because both standards have appealing features.

#Common Mistakes

Choosing ERC-20 by default. The most popular choice isn't always right. If your token needs any form of transfer restriction, starting with ERC-20 and adding compliance later is more expensive than choosing a security standard from the beginning.

Over-engineering the standard. If you're building a straightforward governance token with no securities characteristics, ERC-3643's compliance apparatus is overhead you don't need. Match the standard to the requirement.

Ignoring ecosystem support. A standard that no wallet or exchange supports is technically impressive and practically useless. Check that your target listing venues support your chosen standard before committing.

Treating the standard as permanent. Token migrations are possible but expensive. Design for current requirements, but understand upgrade paths. If your project might evolve toward regulated securities, choose a standard with a clear migration path.

Not documenting the decision. In your data room checklist, token standard selection should include the rationale, alternatives considered, and reasons for rejection. Investors want to see a deliberate choice, not a default.

Token standard selection reverberates through your entire project — from smart contract architecture to exchange listings to regulatory compliance. Get it right early and everything downstream is easier.

If you're building onchain and need your token standard to support your business model, compliance requirements, and growth plan, book a discovery call. We'll assess your project and tell you whether we're the right fit. Sometimes we're not. We'll tell you that too.