Tokenomics Data Room Checklist: What to Include

The complete checklist for building an investor-ready tokenomics data room. Every document, model, and compliance artifact your stakeholders need.

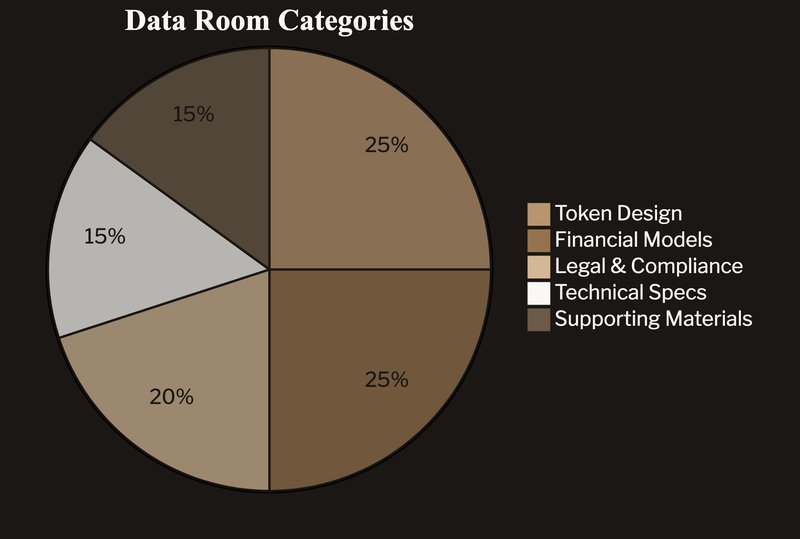

A tokenomics data room checklist covers five categories of documentation: token design artifacts, financial models including Monte Carlo simulations, legal and compliance documents, technical specifications, and supporting materials. Every item on this checklist has been requested by institutional investors during due diligence — if it's listed here, someone will ask for it.

#Why the Checklist Matters

The most common issue we see across 80+ data room engagements isn't bad content — it's missing content. A team spends weeks building financial models, then walks into an investor meeting without a legal opinion. Or they have pristine compliance docs but no stress-tested scenarios.

The stakes for getting this right are significant. Over 53% of the approximately 20.2 million tokens launched since 2021 are no longer trading, according to CoinGecko research (Source: CoinGecko). Many of those projects failed not because the technology was bad, but because the documentation didn't hold up under scrutiny.

"We've seen unprecedented improvements in underlying fundamentals. We expect adoption of stablecoins and other tokenised assets to continue accelerating in 2026." — Mike Giampapa, General Partner, Galaxy Ventures (DL News)

That maturation means investors are more rigorous. They've seen enough failures to know that strong documentation separates projects that survive from projects that don't. Your tokenomics data room needs to be complete before the first investor meeting.

#The Five Categories

A complete tokenomics data room covers five areas using what we call the Five Categories Framework. Miss one and you're leaving investors to fill in blanks with assumptions — and their assumptions will be worse than your reality.

#Category 1: Token Design Documents

This is the foundation. Everything else in the data room rests on your token design decisions. According to Legal Nodes' Web3 due diligence guide, token cap tables, distribution plans, tokenomics principles, and token legal opinions are the baseline for Web3 investor due diligence (Source: Legal Nodes).

Token Model Overview. A clear explanation of how your token works. Not the whitepaper version with the vision statement — the version that answers: what does this token do, who uses it, and why does it hold value?

Supply Architecture. Total supply, initial circulating supply, and the full emission schedule. Fixed, inflationary, deflationary, or hybrid — with the rationale for your choice. If you have burn mechanics or dynamic supply adjustments, document the triggers and thresholds.

Allocation Table. Every allocation bucket with exact percentages: team, advisors, investors by round, ecosystem, treasury, liquidity, staking rewards. No rounding, no "approximately." Investors cross-reference these numbers across every document in the room.

Vesting Schedules. Complete vesting detail for every allocation. Cliff periods, unlock percentages, linear vs. stepped vesting, and acceleration clauses. Show the month-by-month unlock table — "3-year vest with 1-year cliff" alone isn't enough.

Utility Specification. Every use case for the token within your ecosystem. Distinguish between primary utility (core function) and secondary utility (governance, access, rewards). Map each utility to the value it captures.

#Category 2: Financial Models

This is where revenue-first design becomes tangible. With 84.73% of new 2025 tokens trading below their TGE price and 60% losing 70-99% of their value (Source: Cryptorank), investors scrutinize financial models harder than any other section.

Supply-Demand Model. Token supply over time mapped against quantified demand drivers. Three scenarios minimum: conservative, moderate, aggressive. The conservative scenario is the one investors care about most — if the model doesn't work there, it doesn't work.

Monte Carlo Simulations. Run thousands of randomized scenarios across your key variables — user growth, token velocity, market conditions, fee revenue — to produce probability distributions of outcomes. This shows investors the range of what could happen, not just your best guess. Present 10th, 50th, and 90th percentile outcomes.

Revenue Projections. How the protocol generates fees, where those fees flow, and what the fee schedule looks like at different adoption levels. Include both gross and net revenue after operational costs. Map revenue to token holder value accrual.

Stress Test Results. What happens when your key assumptions break? Model a 50% adoption shortfall, a major market downturn in month six, and a competitor launch that splits your user base. Show how the token economy responds to each.

Sensitivity Analysis. Which variables drive the most impact on token value? A table showing how 10-20% swings in each major input affect your key metrics. Investors use this to assess where the real risk lives.

Liquidity Plan. Market-making arrangements, DEX liquidity targets, CEX listing strategy, and the capital allocated to each. Liquidity determines whether your token can actually be traded — and at what cost.

#Category 3: Legal and Compliance

The compliance section has gone from "nice to have" to make-or-break. According to Blockchain App Factory's research, premium exchanges now conduct deep risk assessments on regulatory exposure, token concentration risk, governance controls, operational maturity, and long-term viability (Source: Blockchain App Factory).

Token Classification Analysis. What is your token under applicable law? Utility token, security token, payment token, hybrid? The analysis should cover every jurisdiction where you plan to operate or sell tokens.

Legal Opinions. Formal opinions from qualified counsel on your token's regulatory status. Not a memo from your general counsel — a structured opinion from a firm with crypto-specific expertise. Compliance-ready standards like ERC-3643 are designed specifically for tokens requiring regulatory compliance.

KYC/AML Framework. How you handle identity verification and anti-money laundering requirements. Which provider, what thresholds, how transfer restrictions work at the smart contract level.

Regulatory Strategy. Your approach to evolving regulations. Which frameworks are you designing for — MiCA, anticipated Clarity Act, local securities law? How does your token design accommodate potential reclassification?

Terms and Conditions. Token sale terms, token holder rights, dispute resolution mechanisms, and limitation of liability. Reviewed by counsel with token-specific experience.

#Category 4: Technical Specifications

Your developers and your investors' technical advisors both need this section. Ridgeway Financial Solutions emphasizes that smart contract code repositories and audit reports from firms like Certik or Trail of Bits are expected inclusions in any fundraising data room (Source: Ridgeway Financial Solutions).

Smart Contract Architecture. Contract structure, inheritance patterns, upgrade mechanisms if any, and the rationale for each design choice. Include a contract interaction diagram showing how components connect.

Token Standard Selection. Which standard — ERC-20, ERC-1400, ERC-3643 — and why. How does the standard support your compliance requirements and utility design?

Security Audit Reports. Third-party audit results for any deployed or finalized contracts. Include the auditor's scope, findings, severity ratings, and your remediation of each finding.

Implementation Roadmap. Phased rollout plan with specific milestones, dependencies, and go/no-go criteria for each phase. Investors want to see that you've thought through the execution sequence.

#Category 5: Supporting Materials

These documents round out the package and address questions that don't fit neatly into the other categories.

Whitepaper. The whitepaper tells the story; the data room provides the proof. Include it — investors use both. Make sure the numbers in the whitepaper match the numbers in the data room exactly.

Pitch Deck. The current version, consistent with data room numbers. Investor analysts cross-reference these documents. Discrepancies between your deck and your models are a red flag.

Team Backgrounds. Relevant experience, previous projects, and track record. Not LinkedIn bios — focused summaries that demonstrate why this team can execute on this specific token model.

Comparable Analysis. How does your tokenomics compare to successful projects in your vertical? Where do you differ and why? This shows you've done your homework and aren't designing in a vacuum.

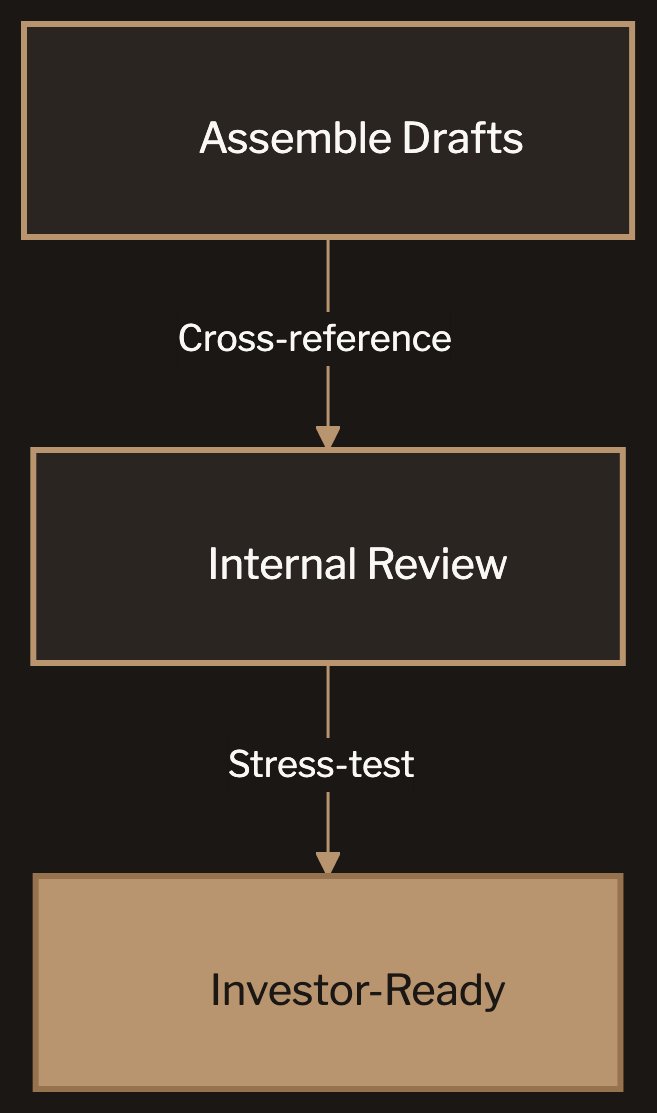

#From Draft to Investor-Ready

Having the documents isn't enough. A data room needs to be organized, internally consistent, and professionally presented.

Assemble the drafts. Get every document into the data room, even in rough form. Gaps become visible immediately. We've seen teams realize they have no sensitivity analysis or no legal opinion only after assembling everything in one place.

Run an internal review. Cross-reference numbers across documents. Does the allocation table in the token design match the financial model? Do the vesting schedules in the term sheet match the supply model? Inconsistencies are the number one thing that slows down due diligence.

Stress-test the package. Have someone unfamiliar with the project answer common investor questions using only the data room. If they can't find an answer, it's not in there. If answers contradict each other, you have a consistency problem.

Professional presentation. Consistent formatting, clear file naming, logical folder structure. A well-organized data room signals institutional-grade execution. Our EcoYield case study demonstrates how this applies to real-world asset tokens.

If you're preparing for a raise and want an institutional-grade data room that holds up under scrutiny, book a discovery call. We'll assess where your documentation stands and tell you what's missing. Sometimes the answer is "not much." We'll tell you that too.